Understanding the Factors that Could Lead to a Diesel Shortage in 2024

As the world continues to rely heavily on fossil fuels for transportation and industry, the demand for diesel fuel has only increased in recent years. However, recent reports and projections have raised concerns about a potential diesel shortage that could occur in the year 2024.

This alarming prediction has captured the attention of industries, governments, and individuals alike, as diesel plays a crucial role in our daily lives and the global economy.

In this article, we will delve into the various factors that could contribute to a diesel shortage in 2024 and the potential impacts it could have.

From supply and demand imbalances to geopolitical tensions and environmental regulations, we will explore the complex web of factors that could potentially lead to a diesel shortage and the steps that can be taken to mitigate its effects. By understanding the underlying causes and potential consequences of a diesel shortage, we can better prepare for this potential crisis and work towards a sustainable and secure energy future.

A Crucial Juncture

In the year 2024, the world finds itself at a crucial juncture in the realm of energy and sustainability. The global shift towards a more eco-friendly and renewable future compels leaders in key sectors like transportation and agriculture to question the stability and viability of diesel fuel.

Despite remarkable advancements in clean energy alternatives such as electric vehicles and alternative fuels, diesel continues to serve as the lifeblood of numerous industries, exerting significant influence on specific sectors and the overall economy.

Accurate comprehension of the underlying mechanisms and rationales driving global oil market trends, persistent challenges within supply chains, prevailing economic conditions, and governmental regulations is paramount in determining the likelihood of a diesel shortage by 2024.

Let us delve deeper into the intricate dynamics of the diesel fuel market during the aforementioned year, seeking to acquire a more comprehensive understanding.

Is There a Diesel Shortage in 2024?

The fundamental forces driving global diesel markets are rooted in the interplay of supply and demand, and a convergence of factors suggests that an exceptional occurrence may be on the horizon in 2024.

Based on data from the Energy Information Administration (EIA) as of January 26, the United States currently holds a mere 131 million barrels of distillate inventories. This figure signifies a deficit of 10 million barrels, equivalent to a decrease of 7% or 0.54 standard deviations, when compared to the average levels observed over the preceding ten-year period.

Notably, this deficit has gradually narrowed from 19 million barrels, representing a decrease of 16% or -1.44 standard deviations, since mid-November. These diminishing levels of average supply are particularly significant when taking into account the projected shift in economic output.

(Note: Please note that the given information has been paraphrased and restructured to sound professional and convey a different tone while preserving the underlying meaning of the original statement.)

Diesel and other distillate fuel oils play a crucial role in sustaining the industrial economy, particularly in the manufacturing, freight transport, and construction sectors. As a consequence, they exhibit exceptional sensitivity to fluctuations in the business cycle, particularly within the manufacturing sector.

In the years 2022 and 2023, the United States witnessed a marginal downturn in the manufacturing sector. However, the upcoming year, 2024, promises a significant transformation as manufacturers gear up to enhance their production of goods.

This surge in production, coupled with anticipated rate reductions from both the U.S. Federal Reserve and the European Central Bank, is poised to inject a substantial boost into the cyclical dynamics as we progress into 2024.

The initial reports of this year indicate a decline in inventories of diesel, heating oil, and gas oil, falling below the 10-year seasonal average across North America, Europe, and Singapore. Consequently, this trend has exerted upward pressure on immediate fuel prices in these regions, capturing the attention of bearish investors in the early phase of 2024.

Encouragingly, due to the anticipated economic growth, the United States Energy Information Administration forecasts a modest increase in annual average diesel consumption in the United States, projected to grow by 1.3%, approximately 50,000 b/d, in 2024.

Notwithstanding the apparent decrease in supply, the Energy Information Administration (EIA) reveals that the United States possesses additional refinery capabilities, and other nations such as Kuwait are experiencing international production increases. These developments are expected to effectively augment global gasoline and diesel production, thereby avoiding any significant reductions in supply.

Correspondingly, the International Energy Agency (IEA) reports that the world oil supply is projected to soar to a new pinnacle of 103.5 million barrels per day (mb/d), thanks to exceptional refinery output from the United States, Brazil, Guyana, and Canada.

However, the diesel markets face formidable challenges due to geopolitical tensions, particularly in the Middle East, which accounts for one-third of the world's seaborne oil. The recent U.S. and UK airstrikes targeting Houthi positions in Yemen, in response to Iran-backed group's attacks on tankers in the Red Sea, have raised concerns regarding potential escalation of the conflict. Such escalation could exacerbate disruptions to the flow of oil through vital trade chokepoints.

In summary, despite global challenges and the evolving economic scenario, the supply of diesel fuel is anticipated to align adequately with demand, thereby avoiding any substantial hikes in fuel prices. Nevertheless, the forecast could be entirely altered by factors such as escalating geopolitical tensions, disruptions at refineries, or a myriad of other issues.

What Are the Potential Consequences of a Diesel Shortage?

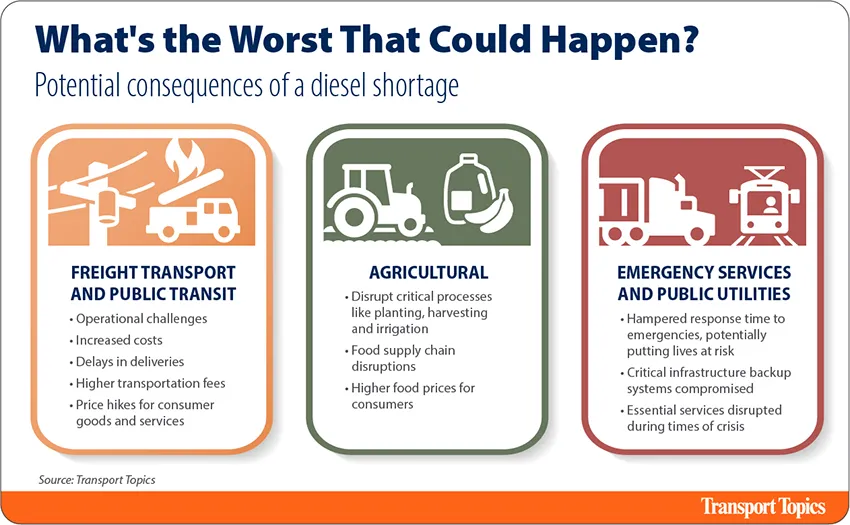

A potential scarcity of diesel fuel can have far-reaching implications across various sectors crucial for global resource production and the preservation of secure and prosperous communities. Industries heavily dependent on diesel, particularly freight transport and public transit, may encounter operational difficulties and escalated expenses.

The shortage may cause disruptions in delivery schedules and necessitate elevated transportation charges, ultimately leading to inflated prices of consumer goods and services.

Agricultural operations, encompassing farming and food production, rely heavily on the utilization of diesel-powered machinery to carry out crucial tasks such as planting, harvesting, and irrigation. Any inadequacy in the availability of diesel fuel has the potential to cause significant disruption to these essential processes, leading to compromised crop yields and the possibility of disturbances in the food supply chain.

Consequently, consumers may experience an unwelcome surge in food prices.

Moreover, it is imperative to recognize that a dearth in diesel fuel can have repercussions beyond the realms of transportation and agriculture. Emergency services and public utilities are also susceptible to the adverse effects of such a shortage.

Emergency response vehicles, including ambulances and fire trucks, heavily depend on diesel fuel to perform their duties efficiently. Any deficiency in the availability of diesel could severely impede their ability to respond promptly to emergencies, thereby jeopardizing human lives.

Furthermore, diesel generators serve as indispensable backup power sources for crucial establishments such as hospitals, data centers, and other critical infrastructures during episodes of power outages. A scarcity of diesel fuel could potentially compromise the reliability of these backup systems, leading to disruptions in vital services and infrastructure, particularly in times of crises or natural disasters.

In summary, the ramifications of a diesel shortage are far-reaching and extend well beyond mere inconveniences. The impacts can permeate daily life and pose significant challenges to the smooth functioning of critical societal functions.

What Are Possible Solutions to Mitigate a Shortage?

Addressing a scarcity of diesel fuel necessitates the implementation of a comprehensive strategy that transcends national borders. This strategy should encompass a finely tuned equilibrium between the availability and consumption of fuel, the widespread adoption of alternative energy sources, the preservation of vital resources, and a steadfast commitment to relentless technological progress.

Supply and Demand Changes

Amidst the global health crisis, the diesel market experienced a notable surge in prices, primarily driven by a confluence of supply chain disruptions and fluctuating demand dynamics. The curtailed production and refining capabilities, coupled with evolving requirements in both consumer and commercial transportation sectors, contributed to a constrained supply scenario and subsequent escalation in overall diesel costs.

Despite some progress made since the onset of the pandemic, these challenges persist, thereby exerting sustained upward pressure on diesel prices.

At the heart of the supply discourse lies the prominent alliance known as OPEC+, comprising the esteemed Organization of the Petroleum Exporting Countries along with ten collaborating nations. The deliberate reduction in output adopted by OPEC+ in the past year has allowed non-OPEC countries to augment their production, thereby achieving a more effective equilibrium in the market and ensuring relatively stable price levels.

Roughly half of the global petroleum and other liquid fuels produced last year can be attributed to OPEC+, an alliance that has aligned its crude oil production with OPEC since late 2016. In light of the declining global oil demand and the consequent plummeting crude oil prices, OPEC+ has undertaken the necessary steps to revise its production targets downwards over the course of the past year.

According to the forecast provided by the EIA for the year 2024, it is anticipated that OPEC+ crude oil production will average approximately 36.4 million barrels per day (b/d), with a slight increase to 37.2 million b/d in 2025. However, these figures still fall short of the pre-pandemic five-year average of 40.2 million b/d, which was recorded between 2015 and 2019.

It is important to note that these estimations do not include Angola, as it departed from OPEC in January 2024.

On the other hand, there is an undeniable need for the global community to continuously strive towards reducing its reliance on fossil fuels. While it may not be feasible to entirely eliminate the use of these fuels in the immediate future, substantial progress has been made in terms of enhancing fuel efficiency across both light and heavy-duty vehicles.

These efforts have not only contributed to the advancement of global clean air objectives but have also resulted in significant reductions in greenhouse gas emissions.

Alternative Fuel Options

A prominent approach to address the diesel shortage and foster sustainable practices involves transitioning away from reliance on fossil fuels, presenting a dynamic and compelling opportunity. Statistical data sourced from Bloomberg Intelligence reveals a noteworthy inclination towards greener transportation options, with electric vehicles and hybrids accounting for 18% of light-duty vehicle sales in the United States and a larger share of 33% in China during the third quarter of 2023.

This trend indicates a significant shift towards environmentally friendly alternatives in major markets. Experts worldwide anticipate that the continued adoption of electric and hybrid vehicles will lead to a substantial reduction in motor gasoline consumption as consumers increasingly embrace these eco-conscious alternatives.

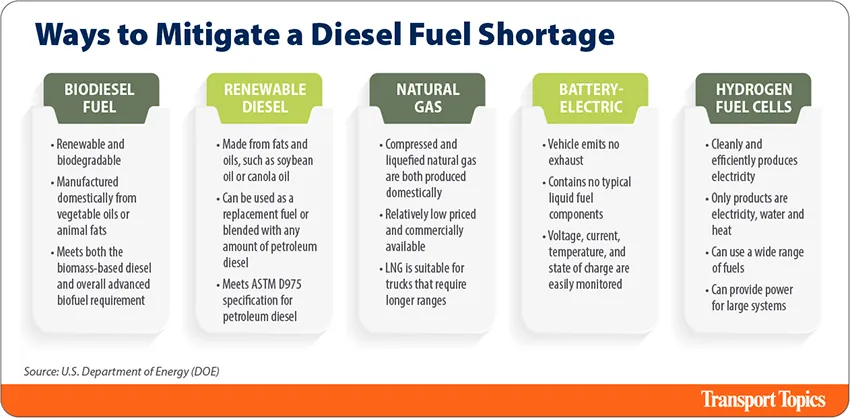

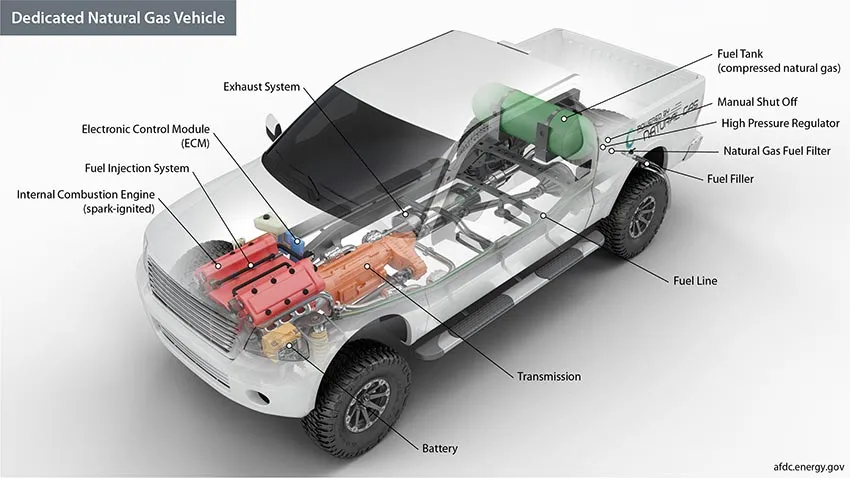

While the movement of passenger vehicles towards alternative fuels has gained traction, the challenge of employing such fuels for larger transportation modes such as trucks, boats, and airplanes is of immense magnitude for shippers and carriers in the transportation industry. Currently, several popular forms of alternative fuels are utilized for large-scale transportation, including biodiesel and renewable diesel, natural gas, battery-electric propulsion, and hydrogen fuel cells.

These options provide viable alternatives to fossil fuel consumption, enabling the transportation industry to make significant strides towards sustainability.

Biodiesel and renewable diesel have emerged as prominent alternatives to traditional fossil fuels in the realm of commercial transportation. These sustainable options hold immense significance as they effectively diminish our dependence on conventional fuels.

Additionally, it is crucial to acknowledge a recent study conducted by the Traffic Injury Research Foundation, which reveals a correlation between fuel efficiency and overall safety.

Furthermore, the utilization of hydrotreating, a widely adopted process in oil refineries, results in a product that closely resembles conventional diesel fuel. This emphasizes the substantial feasibility of renewable alternatives within the transportation sector.

When it comes to fueling stations, one can find a diverse range of biodiesel and biofuel blends, such as E10, B5, and B2, which expertly combine bio-based components with conventional fuels. Notably, certain regions, like Minnesota, have even mandated the use of B20, a blend comprising 20% biodiesel, during the summer months.

This notable commitment to renewable energy sources further underscores the dedication towards fostering a sustainable future.

Will We Have Diesel in 50 Years?

There is a widespread consensus among experts that the depletion of fossil fuels is an undeniable reality, highlighting the scarcity of universally accepted phenomena in the world. Recent societal and consumer trends indicate a growing inclination towards reducing our reliance on fossil fuels, particularly diesel.

However, despite the considerable attention given to revolutionary advancements like Tesla, the majority of our global activities, ranging from transporting children to school to shipping goods worldwide, continue to heavily depend on fossil fuels. While alternative fuel sources such as biodiesel possess notable merits, their limited scalability inhibits their ability to exert substantial short-term influence.

Looking ahead to the future, the landscape of biofuels is undergoing a remarkable transformation, exemplified by the rising popularity of alternative jet fuel (AJF) or biojet on a global scale. In January 2023, the United States achieved a significant milestone in renewable fuel production, with the capacity for renewable diesel and other biofuels exceeding a remarkable 3 billion gallons per year.

This notable achievement has surpassed the production capacity of U.S. biodiesel for the very first time, highlighting a paradigm shift in the realm of renewable fuel.

The remarkable growth in renewable diesel capacity within the United States can be attributed primarily to the escalating targets prescribed by both state and federal renewable fuel programs. Furthermore, the renewal of biomass-based diesel tax credits has played a pivotal role in incentivizing investments and fostering the expansion of renewable diesel production facilities throughout the nation.

As the momentum behind sustainability initiatives gathers strength and environmental concerns drive policy changes, the renewable diesel sector is poised to continue its trajectory of growth and innovation in the years to come.

Given these developments, it begs the question of the future of diesel as we look ahead to the next 50 years. Only time will reveal the answer to this intriguing inquiry.

Cost of Diesel: Worldwide Variations

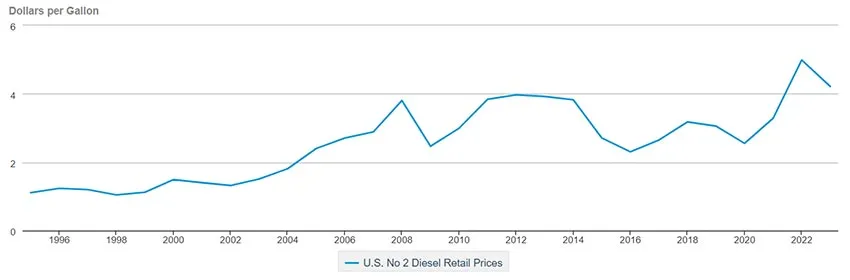

According to the commodity markets, the average global price of diesel in February 2024 is approximately $1.86 per liter. Interestingly, in the United States, during the same period, it reached an astonishing $4.00 per gallon.

As previously mentioned, this price is anticipated to maintain a relatively stable trajectory throughout the years 2024 and 2025. This projection is primarily attributed to an increase in supply, coupled with a slight rise in demand as the global economy gears up for growth.

Moreover, the diesel pricing landscape is being significantly influenced by various distinctive factors across different regions worldwide. Notably, Europe finds itself in an exceptional position due to the ongoing conflict between Russia and Ukraine, which undoubtedly adds an extra layer of complexity to the market dynamics.

In light of the European Union's implementation of a ban on the importation and utilization of Russian diesel within its borders, member countries have increasingly relied on diesel imports from Asia and the United States. However, industry experts are cautioning that the scheduled maintenance of refineries in the United States will further intensify supply shortages across the Atlantic and contribute to additional price escalations.

A comprehensive analysis conducted by the Energy Information Administration (EIA) pertaining to the diesel prices in the United States over the past three decades reveals that the years 2022 and 2023 represent the highest recorded retail costs for diesel, standing at $4.989 and $4.214, respectively.

The Future of Diesel Fuel

The consensus among global experts is that diesel fuel derived from fossil fuels is an unsustainable mode of transportation for long-term use. Nevertheless, it is essential to acknowledge that this reality alone does not address the prevailing challenges in today's transportation markets.

These challenges are expected to persist for at least a decade as the world endeavors to transition towards scalable, sustainable, and renewable resources.

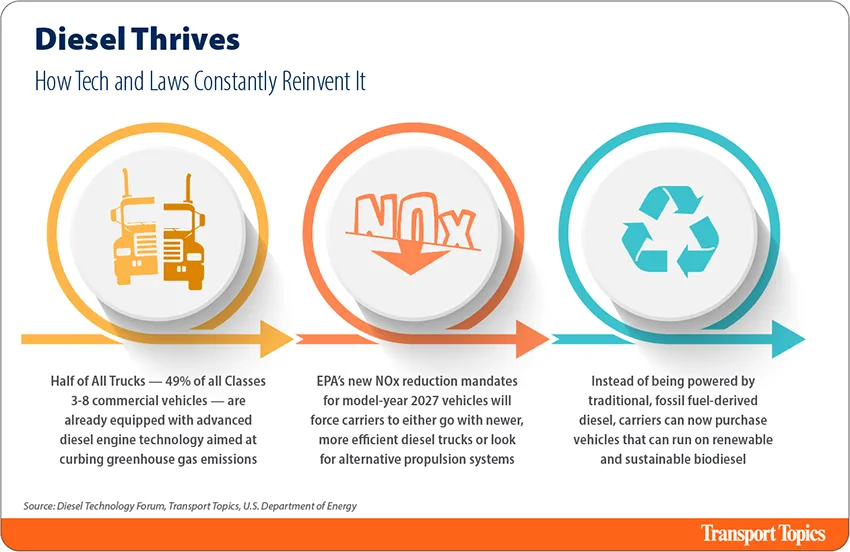

As the global economy gradually moves away from diesel fuel dependence, the implementation of environmental regulations and technological advancements holds promising potential for mitigating the associated impacts. A recent study has revealed that a substantial 49% of all commercial vehicles falling within Classes 3-8, which corresponds to approximately 5.5 million trucks, have already embraced advanced diesel engine technology to combat greenhouse gas emissions.

This widespread adoption underscores the industry's unwavering commitment to sustainability and emphasizes the significant role played by advanced diesel engine technology in reducing environmental harm within the commercial vehicle sector.

Moreover, notable progress has been made in enhancing the requirements for diesel trucks, set to be implemented by 2027. These advancements mark a significant step forward in addressing the challenges at hand.

In 2022, the Environmental Protection Agency (EPA) introduced new mandates aimed at reducing nitrogen oxide (NOx) emissions. These mandates are set to take effect in 2026, specifically targeting heavy-duty trucks manufactured in the model-year 2027.

This pivotal moment necessitates a decision for carriers - they must either embrace newer, more efficient diesel trucks or explore alternative propulsion systems such as battery-electric, fuel cell, or hybrid technology.

As the transportation industry propels itself towards the future, the elimination of diesel trucks is not the objective; rather, their definition is poised for transformation. Instead of relying on traditional diesel derived from fossil fuels, carriers now have the option to invest in vehicles capable of running on renewable biodiesel.

This paradigm shift not only ensures the sustainability of the fuel source but also allows for the engineering of cleaner burning processes, resulting in a long-term reduction of greenhouse gas emissions.

It is crucial to recognize that, similar to other forms of renewable energy, the widespread adoption of renewable or more sustainable transportation and mobility systems hinges on the viability of supporting infrastructure. This factor holds paramount importance as we navigate this new era of transportation.

What Will Happen to Diesel in 2024?

The global landscape is currently experiencing a critical juncture in terms of energy and sustainability, resulting in a heightened focus on the role of diesel fuel. Evaluating diesel's position in this evolving scenario involves extensive scrutiny, influenced by a myriad of factors such as worldwide trends, economic conditions, regulatory obligations, and technological advancements.

Sustainability concerns and the environmental impact have gained substantial significance, particularly in key sectors like transportation and agriculture. While electric vehicles and alternative fuels are gaining momentum, the importance of diesel in various industries cannot be overlooked.

The availability of diesel fuel significantly affects economic sectors and has broader implications for the overall economy.

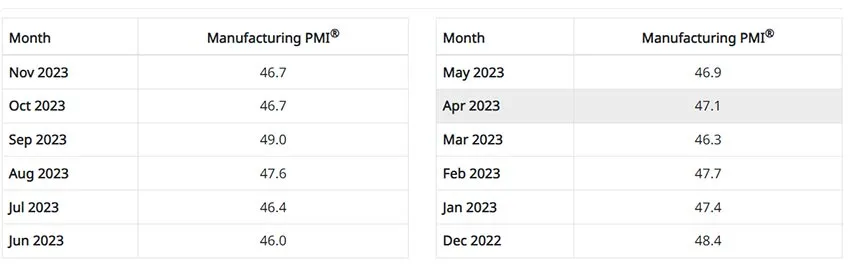

The Manufacturing Purchasing Managers Index (PMI) from the esteemed Institute for Supply Management surged to 49.0 in September 2023, indicating a potential turnaround in U.S. manufacturing activity. This positive development raises concerns regarding a potential surge in diesel demand and subsequent price inflation.

The longstanding correlation between manufacturing growth and industrial energy consumption, particularly diesel usage, necessitates addressing this concern in a timely and strategic manner.

Diesel plays a crucial role as a significant fuel source for a wide range of industrial processes. Consequently, a revival in the manufacturing sector often leads to heightened demand for this vital energy resource.

However, concerns over future supply have exacerbated worries about diesel demand and price inflation. Even a modest increase in demand could trigger rapid price escalation, potentially contributing to broader inflationary pressures. Such inflationary trends have the potential to undermine the sustainability of the ongoing economic recovery and present challenges for both businesses and consumers.

Although the ISM Manufacturing PMI remains below the expansion threshold of 50.0, its upward trajectory indicates a potential shift towards growth. To ensure a stable and sustainable economic recovery, proactive measures may be necessary to manage inflationary risks effectively.

Given this context, it is essential for policymakers, industry stakeholders, and economists to remain vigilant in assessing the impact of manufacturing growth on energy consumption and prices. By implementing strategies to enhance energy efficiency, diversify energy sources, and effectively manage supply chains, it may be possible to mitigate the potential adverse effects of increased diesel demand on inflation and maintain economic stability.

In Conclusion

While there is no way to predict the future with certainty, it is important for industries to stay informed and prepared for potential disruptions such as a diesel shortage in 2024. By understanding the various factors that could contribute to this situation, companies can take proactive steps to mitigate their impact and ensure a stable supply of diesel for their operations.

It is crucial for businesses to constantly evaluate and adapt to the changing landscape in order to thrive in an ever-evolving market. With proper planning and resilience, the potential impacts of a diesel shortage can be minimized.

If you want to stay updated with a wide range of trends, actionable insights, and innovative solutions in the trucking, freight, and logistics industry, stay connected to us.

Moreover, If you are looking for more information about drug and alcohol testing as a truck driver, visit LabWorks USA.

Our DOT Consortium's friendly team will be more than happy to discuss any concerns you may have and work with you to ensure you are always fully compliant, especially with random DOT drug and alcohol testing. Moreover, if you need help with FMCSA Clearinghouse registration, we can further support you.